General Partners

1,700+

Funds

5,700+

Companies

74,000+

Investments

99,000+

What's included?

- Pooled and quartile benchmarking by strategy, industry, and region

- Buyout GICS sector performance by investment entry year

- Performance distributions by sector and investment entry year

- Quartile benchmarking by investment entry year

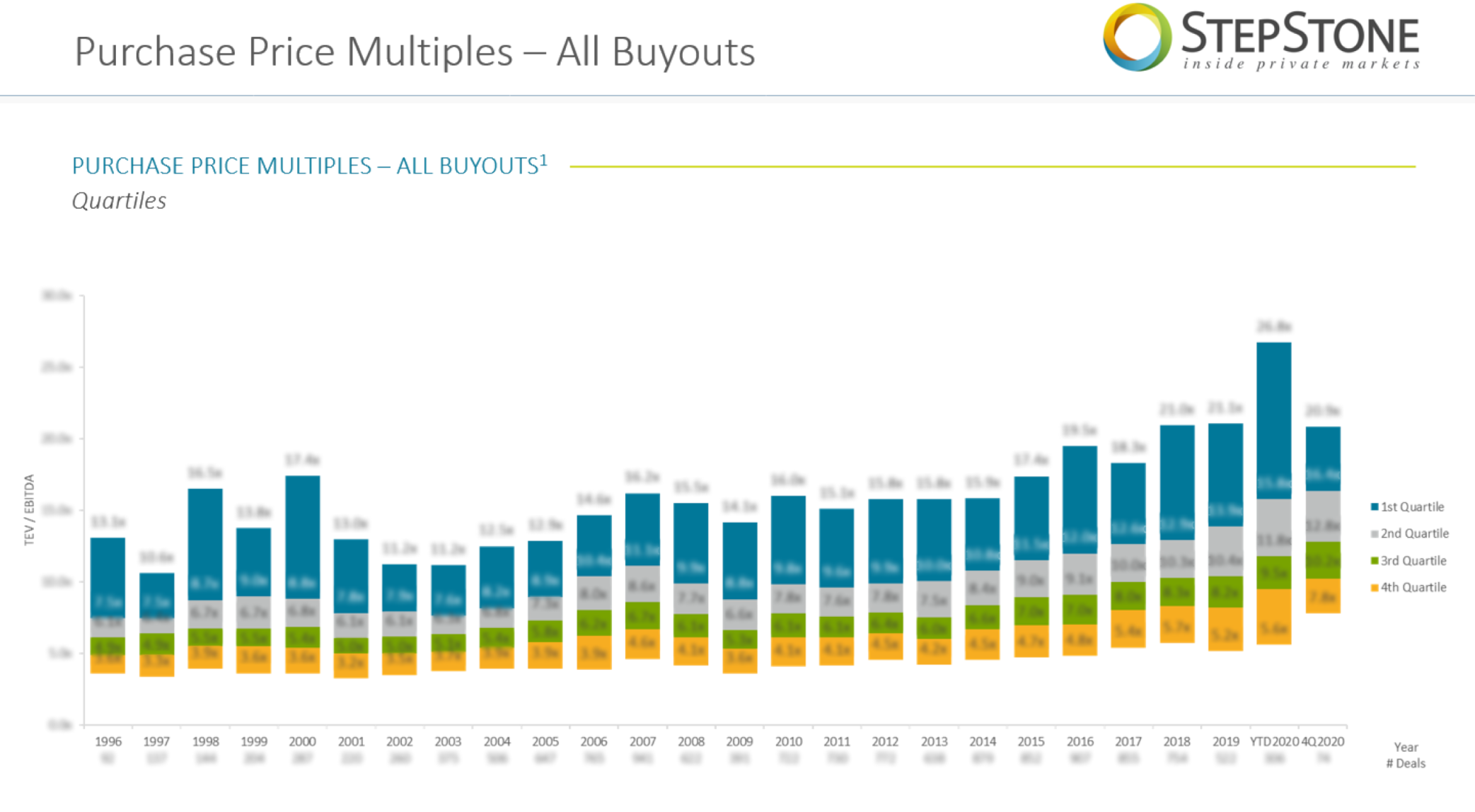

- Operating metric benchmarking across price multiples, leverage mulitples, and equity contribution

- Legal terms benchmarking, including preferred return, management fees, and GP commitments

About StepStone

We are a global private markets firm providing customized investment and advisory solutions to some of the most sophisticated investors in the world.

With $659 billion of total capital responsibility, including $146 billion in assets under management, we cover the spectrum of opportunities in private markets across the globe, deploying over $80 billion in private market allocations annually (as of 9/30/2023).

We prudently integrate fund, secondary, direct and co-investments across private equity, infrastructure, private debt, and real estate to create solutions that are customized according to the objectives of any private markets investment program.

For more information on StepStone, visit our corporate site at stepstonegroup.com.